Municipals were weaker Tuesday as the New York City Transitional Finance Agency, the last sizable new-issue of 2024, priced for institutions, while U.S. Treasuries were mixed and equities saw large losses ahead of the expected FOMC rate decision Wednesday.

That weakness that began last week continued through Tuesday, as participants await the conclusion of Federal Open Market Committee’s December meeting

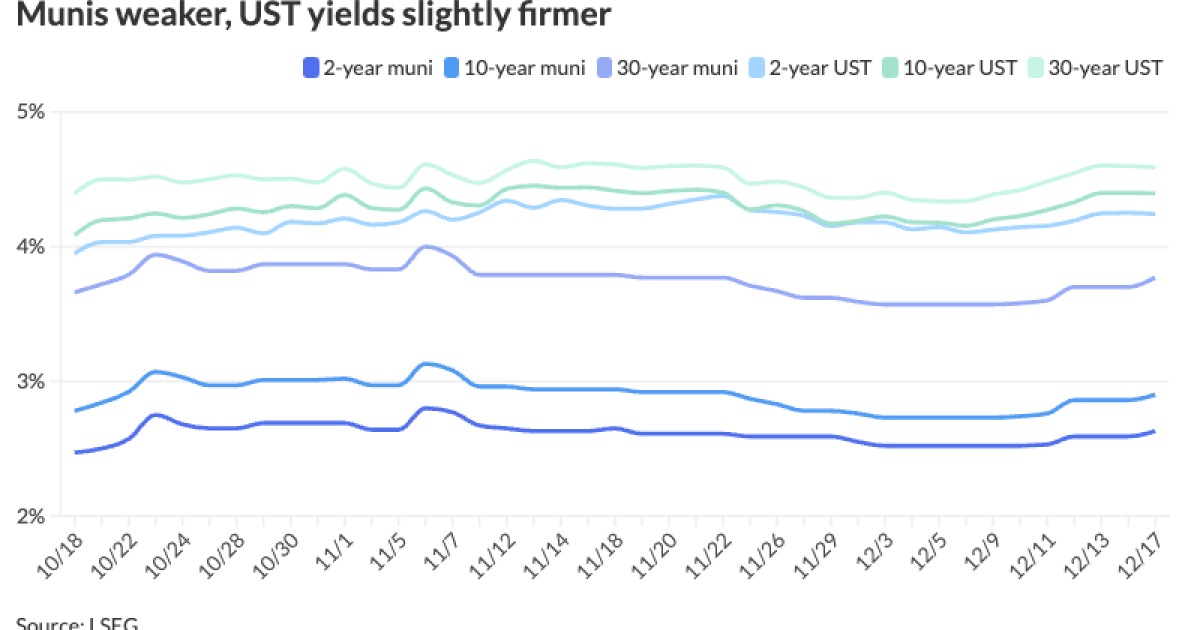

Triple-A municipal yields rose two to seven basis points and USTs were mixed with some pressure on the short end and small gains out long. Muni to UST ratios also rose slightly.

The two-year municipal to UST ratio Tuesday was at 62%, the five-year at 64%, the 10-year at 66% and the 30-year at 82%, according to Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the five-year at 64%, the 10-year at 67% and the 30-year at 81% at 4 p.m.

On the one hand, the quarter-point rate cut should be priced into the market, but “people are already looking beyond it and thinking, ‘What will happen next, if anything?'” said Giles Nicholson, head of the Public Finance Quantitative Solutions Group at Siebert Williams Shank.

If a January cut is “off the table,” some might start to wonder if that indicates the economy’s health is better than expected, he said.

Further rate cuts are likely to be data dependent, Nicholson said.

And as market participants await clarification for further Fed action following the rate cut, they will turn to the language in Chairman Jerome Powell’s speech Wednesday afternoon to see if he offers any clues, he noted.

With investors now anticipating Wednesday’s expected rate cut may be the last one for a while, “an overall bullish paradigm has been seriously weakened,” noted Matt Fabian, a partner at Municipal Market Analytics, Inc.

And even worse, he said, “expectations for federal deficits are brutal inputs to U.S. Treasury supply/demand projections.”

The next 10 years will need an additional $22 trillion of UST supply, according to the Congressional Budget Office.

Another $4 trillion to $14 trillion of potential deficits through tax cuts and other events next year suggest at least a doubling of outstanding USTs by 2034, Fabian said.

In that light, a UST selloff last week seemed “reasonable,” he said.

And tax-exempt munis, “tending a large late-year new-issue calendar amid UST losses, fund outflows, and increasingly realistic fears for the tax exemption next year” saw yields cut four to 12 basis points last week, Fabian said.

And while issuance falls this week, supply is $492.057 billion year-to-date, meaning issuance reaching $500 billion this year seems possible, Fabian said.

Most estimates on the Street call for

With municipalities generally in “solid financial shape,” this outsized supply is not meant to fill their budget gaps, they said.

Market participants think the first quarter could see an influx of issuance.

“With most dealers projecting a very busy 1Q for issuance (and numbers should really rise even higher if issuers begin to appreciate what could be a closing window for tax-exempt financing), yields will need to be higher to keep capturing [separately managed account] demand for attractively priced” premium 4% and 5% coupon bonds, Fabian said.

Several large deals are already popping up on the calendar.

The San Francisco International Airport is set to price the week of Jan. 20 around $1 billion of second series revenue bonds.

JEA is set to price the week of Jan. 20 around $542 million of water and sewer revenue bonds and district energy system revenue bonds.

The University of California may price up to $2.5 billion of general revenue bonds during January.

In the primary market Tuesday, Jefferies priced for institutions $1.5 billion of future tax-secured tax-exempt subordinate bonds, Fiscal 2025 Series E, from the New York City Transitional Finance Authority (Aa1/AAA/AAA/), with bumps on the short and long end of the curve from Monday’s retail pricing: 5s of 11/2026 at 2.69% (unch), 5s of 2029 at 2.85% (-1), 5s of 2034 at 3.13% (-3), 5s of 2039 at 3.47% (+5), 5s of 2044 at 3.85% (+11), 5.5s of 2049 at 3.96% (-2), 4.125s of 2053 at 4.28% (-1) and 5s of 2053 at 4.125%, callable 11/1/2034.

AAA scales

MMD’s scale was cut up to seven basis points: The one-year was at 2.71% (unch) and 2.63% (+4) in two years. The five-year was at 2.70% (+4), the 10-year at 2.90% (+4) and the 30-year at 3.77% (+7) at 3 p.m.

The ICE AAA yield curve was two to five basis points: 2.75% (+2) in 2025 and 2.69% (+4) in 2026. The five-year was at 2.71% (+3), the 10-year was at 2.93% (+4) and the 30-year was at 3.72% (+4) at 4 p.m.

The S&P Global Market Intelligence municipal curve was cut up to six basis points: The one-year was at 2.76% (unch) in 2025 and 2.61% (unch) in 2026. The five-year was at 2.68% (+6), the 10-year was at 2.90% (+6) and the 30-year yield was at 3.72% (+6) at 4 p.m.

Bloomberg BVAL was cut up to five basis points: 2.78% (unch) in 2025 and 2.64% (+2) in 2026. The five-year at 2.71% (+4), the 10-year at 2.95% (+5) and the 30-year at 3.63% (+4) at 4 p.m.

Treasuries were little changed.

The two-year UST was yielding 4.249% (flat), the three-year was at 4.229% (+1), the five-year at 4.262% (+1), the 10-year at 4.398% (flat), the 20-year at 4.677% (-1) and the 30-year at 4.587% (-2) at the close.

Primary to come:

The National Finance Authority is set to price Thursday $68.831 million of nonrated River Ranch Project special revenue capital appreciation bonds, terms 2031. D.A. Davidson.

The Hazelden Betty Ford Foundation Project (Baa1///) is set to price $66.945 million of revenue bonds, consisting of $31.79 million of Series A and $35.155 million of Series 2025B. Ziegler.

The Public Finance Authority (//BB-/) is set to price $61.29 million of CFC-LSH-Amplify Lubbock Project multifamily housing revenue bonds, consisting of $54.3 million of Series 2024A-1, $1.465 million of Series 2024A-2 and $5.525 million of Series 2024B. Ziegler.

The Missouri Health and Educational Facilities Authority (//BBB/) is set to price $41.61 million of Lutheran Senior Services Projects senior living facilities revenue bonds, Series 2025A. Ziegler.

Competitive

The Triborough Bridge and Tunnel Authority is set to sell $186 million of second subordinate revenue bond anticipation notes, Series 2024A, at 10:45 a.m. Thursday.